5 Myths About Personal Loans in India You Need to Stop Believing

Table of Contents

- • Introduction

- • Myth 1: Personal Loans Are Only for Emergencies

- • Myth 2: Personal Loans Have Exorbitant Interest Rates

- • Myth 3: Personal Loans Take Too Long to Process

- • Myth 4: You Need a Perfect Credit Score to Get a Personal Loan

- • Myth 5: Prepayment of Personal Loans Involves Heavy Penalties

- • Credit Card vs Personal Loan in India: Which is Better for Financial Needs?

- • Key Points Summary

- • FAQs

Introduction

Personal loans are one of the most versatile financial tools available to individuals in India. Despite their popularity, many myths surround them, which often deter potential borrowers or lead to misconceptions. If you're deciding between a credit card vs personal loan in India or evaluating your options for addressing your financial needs, it’s essential to separate fact from fiction. In this blog, we debunk five common myths about personal loans to help you make informed decisions.

Personal Loans Are Only for Emergencies

While personal loans are often used for emergencies, such as medical bills or urgent home repairs, they are not limited to these purposes. You can use a personal loan for:

• Funding a wedding or a vacation

• Consolidating debt

• Home renovations

• Education expenses

Personal loans provide the flexibility to meet various financial needs, making them a versatile option.

Personal Loans Have Exorbitant Interest Rates

The belief that personal loans always come with high interest rates is outdated. Interest rates for personal loans in India have become competitive over the years. Borrowers with good credit scores can avail loans at rates as low as 10-12% per annum.

Factors influencing interest rates include

• Credit score: Higher scores lead to lower rates.

• Loan tenure: Shorter tenures may have lower rates.

• Income stability: Stable income attracts better terms.

When comparing options, consider both the interest rate and the processing fees to assess the total cost of the loan.

Personal Loans Take Too Long to Process

Gone are the days when personal loans required extensive paperwork and long processing times. Many lenders now offer instant personal loans, with approval and disbursal happening within 24 to 48 hours. Digital platforms have further simplified the process, enabling borrowers to apply online and upload necessary documents without visiting a branch.

Here’s what you typically need for quick processing:

• Proof of identity (Aadhaar, PAN, etc.)

• Proof of income (salary slips, bank statements, ITR)

• Proof of address

You Need a Perfect Credit Score to Get a Personal Loan

Although a good credit score (750 and above) improves your chances of approval, it’s not the sole criterion. Many lenders consider other factors such as:

• Income level: A stable and sufficient income can offset a low credit score.

• Employment stability: Working with a reputable employer adds credibility.

• Existing debt: A low debt-to-income ratio works in your favor.

Even if you have a low credit score, you can still secure a loan by opting for a higher interest rate or applying with a co-applicant who has a strong credit profile.

Prepayment of Personal Loans Involves Heavy Penalties

Prepayment penalties were once standard in personal loan agreements, but the landscape has evolved. Today, many banks and NBFCs (Non-Banking Financial Companies) offer personal loans with minimal or no prepayment charges. Even when penalties apply, they are often outweighed by the savings on interest payments.

Before taking a loan, inquire about:

• Prepayment terms: Are partial payments allowed?

• Lock-in periods: Is prepayment restricted for the first year?

• Fees: How much is charged for early repayment?

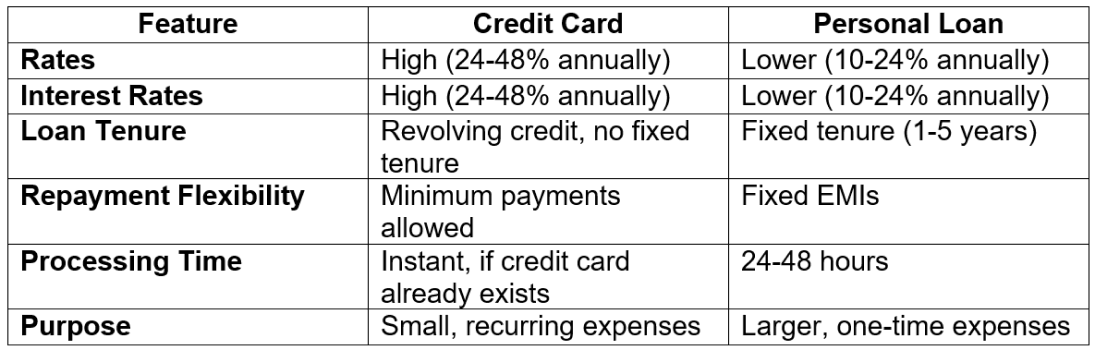

Credit Card vs Personal Loan in India: Which is Better for Financial Needs?

When faced with immediate financial needs, you may wonder whether to opt for a credit card or a personal loan. Here’s a quick comparison:

By dispelling these myths, you’re better equipped to make financial decisions that align with your needs. Whether it’s choosing between a credit card vs personal loan in India or understanding the nuances of loan vs card financial needs, informed decisions can help you achieve financial stability.

Frequently Asked Questions

Q1: What’s the difference between a personal loan and a credit card loan?

A: A personal loan is a lump sum disbursed for a fixed tenure, while a credit card loan is essentially a loan on your card’s credit limit with higher interest rates. Personal loans are better for larger, planned expenses.

Q2: Can I apply for a personal loan online?

A: Yes, most banks and NBFCs allow you to apply for personal loans online, providing a seamless and quick process.

Q3: How much can I borrow with a personal loan?

A: The amount depends on your income, credit score, and lender policies. Salaried individuals can typically borrow 10 to 20 times their monthly income.