Step-By-Step Guide to Applying for an Instant Personal Loan with Ayaan Finserve

Now that you have a clear understanding of the benefits and eligibility criteria, let's walk through the steps to apply for an Instant Personal Loan online with Ayaan Finserve.

Step 1: Visit the Ayaan Finserve Website

Start by visiting the official website of Ayaan Finserve (www.afiloans.co.in). The website is designed to be user-friendly, ensuring that you can navigate through the different sections with ease. Look for the "Get a Loan" button on the homepage.

Step 2: Create an Account

If you are a new user, you'll need to create an account on the website. This involves providing your basic details, such as your name, location, mobile number, and creating a secure password. Once you've registered, you can log in using your credentials.

Step 3: Fill in the Application Form

After logging in, you'll be directed to the loan application form. Here, you'll need to provide your personal details, employment information, and loan requirements. Be sure to enter accurate information to avoid any delays in the approval process.

Step 4: Upload the Required Documents

Next, you'll be prompted to upload the necessary documents for verification. Ensure that the scanned copies are clear and legible. The platform will guide you on how to upload these documents securely.

Step 5: Choose Your Loan Amount and Tenure

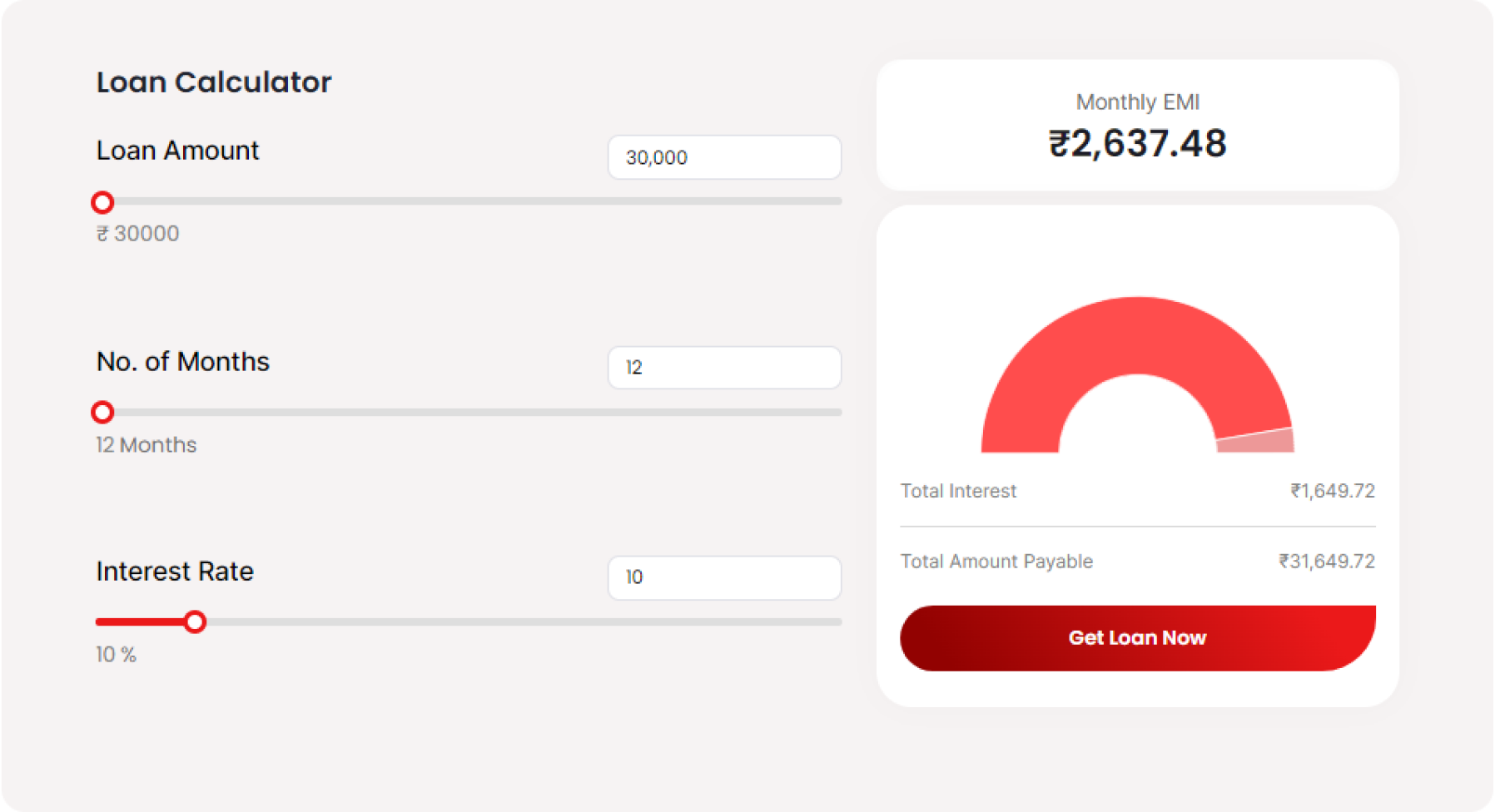

Ayaan Finserve allows you to choose the loan amount and repayment tenure that suits your needs. You can use the online loan calculator available on the website to get an estimate of your monthly installments based on the loan amount and tenure you select.

Step 6: Review and Submit Your Application

Before submitting your application, take a moment to review all the details you've entered. Double-check the loan amount, tenure, and uploaded documents. Once you're satisfied, click on the "Submit" button.

Step 7: Instant Approval and Disbursal

Ayaan Finserve's online platform uses advanced algorithms to process your application instantly. If all the information is accurate and you meet the eligibility criteria, your loan will be approved within minutes. The approved loan amount will be disbursed directly to your bank account, often within a few hours.

Tips for a Smooth Loan Application Process

While the online loan application process with Ayaan Finserve is designed to be hassle-free, here are some tips to ensure a smooth experience:

Ensure Document Readiness:

Keep all the required documents handy before starting the application process. This will save time and prevent unnecessary delays.

Check Your Credit Score:

A good credit score increases your chances of loan approval. If possible, check your credit score before applying and take steps to improve it if needed.

Accurate Information:

Ensure that all the information you provide is accurate and up-to-date. Inconsistencies may lead to delays or rejection of your application.

Read the Terms and Conditions:

Before finalizing your loan application, carefully read the terms and conditions provided by Ayaan Finserve. This will help you understand the loan's interest rates, repayment schedule, and any associated fees.

Frequently Asked Questions (FAQs)

While the online loan application process with Ayaan Finserve is designed to be hassle-free, here are some tips to ensure a smooth experience:

Q1. How long does it take to get the loan amount disbursed?

A: Once your loan is approved, the amount is typically disbursed to your bank account within a few hours.

Q2: Can I apply for an instant small loan if I have a low credit score?

A: While a good credit score is preferred, minimum required cibil only 500 Ayaan Finserve may consider other factors also in your application.

Q3: Can I prepay my loan?

A: Yes, Ayaan Finserve allows prepayment of loans. However, it's advisable to check for any prepayment charges before proceeding.

Conclusion

Applying for an instant small loan online with Ayaan Finserve in Delhi is a quick and efficient way to meet your financial needs. With a straightforward application process, minimal documentation, and fast approval, you can secure the funds you need without the hassle of traditional lending procedures. Whether you're dealing with an emergency or need extra cash for personal expenses, Ayaan Finserve's online platform is here to help. Make sure to assess your financial situation, choose the right loan amount, and adhere to the repayment schedule to enjoy a stress-free borrowing experience.