Bike Loan vs. Personal Loan: Which is the Better Option for You?

Table of Contents

- • Introduction

- • What is a Bike Loan?

- • What is a Personal Loan?

- • Bike Loan vs Personal Loan: The Key Differences

- • When Should You Choose a Bike Loan?

- • When is a Personal Loan Better?

- • Pros and Cons

- • Related Key Points

- • Summary

- • FAQs

Introduction

Buying a bike is exciting — whether it's your first ride or you're upgrading to something more stylish. But let’s be real: not everyone has the full amount saved up. That’s where financing options come into play. And if you're wondering whether to go for a bike loan or a personal loan, you're not alone.

This blog breaks down everything you need to know in the personal loan vs bike loan debate so you can make the right decision based on your lifestyle, budget, and financial goals.

What is a Bike Loan?

A bike loan is a type of vehicle loan specifically for purchasing a two-wheeler. It’s usually a secured loan, meaning the bike you're buying is used as collateral. The lender owns the bike (technically) until you’ve repaid the loan.

Key Features:

- Loan amounts up to 100% of the bike’s cost

- Lower interest rates (compared to personal loans)

- Loan tenure up to 5 years

- The bike remains hypothecated until the loan is repaid

What is a Personal Loan?

A personal loan is an unsecured loan, meaning you don’t need to pledge any asset — like your bike — as collateral. It can be used for any purpose, including buying a two-wheeler

Key Features:

- Flexibility in usage

- Slightly higher interest rates

- Loan tenure can range from 1 to 7 years

- No hypothecation involved

So, when comparing personal loan vs bike loan, this flexibility is a key differentiator.

Eligibility Criteria for Bike Purchase on EMI

To qualify for a bike purchase on EMI, you need to meet certain criteria:

- Age : 21-65 years

- Income : Minimum ₹10,000-₹15,000 per month (varies by lender)

- Employment : Salaried or self-employed

- Credit Score : Preferably 650+ (but some lenders offer loans with lower scores)

- Residency : Must be an Indian citizen with valid ID proof

How to Buy a Bike on EMI: Step-by-Step Process

1. Choose Your Bike

Decide on the brand, model, and variant that fits your needs and budget.

2. Check Loan Offers

Visit different banks and NBFCs to compare EMI plans, interest rates, and tenure options.

3. Calculate EMI

Use an online EMI calculator to estimate your monthly payments based on the loan amount and tenure.

4. Submit Documents

Provide necessary documents like ID proof, address proof, income proof, and bank statements

5. Loan Approval & Down Payment

Once approved, pay the required down payment (usually 10-25% of the bike’s cost).

6. Bike Delivery

After completing the formalities, your bike will be delivered, and EMI payments will begin as per your agreement.

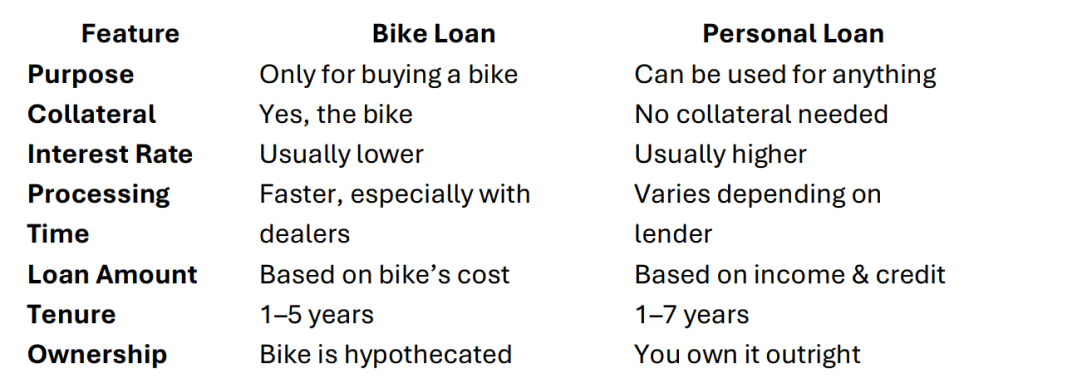

Bike Loan vs Personal Loan: The Key Differences

As you can see, the bike loan vs personal loan decision hinges on what you're prioritizing: flexibility or cost-effectiveness.

When Should You Choose a Bike Loan?

Go for a bike loan if:

- You’re only buying a bike and want a simple, quick loan process

- You’re okay with the lender holding ownership until repayment

- You want lower EMIs and interest rates

- You're purchasing the bike from an authorized dealer

This option is great if you’re clear about what you want and just need support with financing.

When is a Personal Loan Better?

Opt for a personal loan if:

- You need funds not just for the bike, but also for insurance, gear, or registration

- You want complete ownership of the bike from day one

- You don’t want your asset tied up as collateral

- You’re confident about getting a good rate based on your credit score

In the personal loan vs bike loan context, this gives you more freedom but may cost a bit more in interest.

Pros and Cons

Bike Loan

Pros :

- Lower interest rates

- Easier approval with dealer tie-ups

- Can finance up to 100% of bike’s value

Cons :

- Limited to bike purchase only

- Hypothecation means you don’t fully own the bike until repayment

Personal Loan

Pros :

- Full ownership from the start

- Flexible usage of funds

- No collateral required

Cons :

- Higher interest rates

- Loan approval depends on creditworthiness

Related Key Points

- Always compare EMI options and processing fees before deciding

- Look out for seasonal dealer offers that can reduce interest rates on bike loans

- Use loan EMI calculators to check your affordability

- If you need money beyond the bike purchase (for insurance, modifications, etc.), a personal loan makes more sense

- Your income, credit score, and current liabilities play a major role in loan approval

Choosing between a bike loan vs personal loan isn’t just about the loan — it’s about your overall financial health and priorities

Summary

Let’s wrap this up! If you’re only looking to buy a new bike and want lower interest rates, a bike loan is probably your best bet. It’s fast, easy, and usually comes with low EMIs.

But if you want more flexibility — maybe you’re buying a used bike or need extra cash for insurance or accessories — a personal loan gives you that room to breathe.

So, in the ultimate personal loan vs bike loan debate, the winner really depends on you — your needs, your finances, and your plans.

Also Read : Especially Useful for Smaller, Used-Bike Purchases

Common FAQs

Q1: Which is cheaper — a personal loan or a bike loan?

A: Generally, bike loans are cheaper in terms of interest rate. However, depending on your credit score, some personal loans can be competitive too.

Q2: Can I use a personal loan to buy a second-hand bike?

A: Yes! That’s one of the advantages of personal loans. Most bike loans are for new bikes only.

Q3: Will my credit score be affected by either loan?

A: Yes. In both cases, timely repayments will improve your credit score, while defaults can bring it down.

Q4: Can I foreclose either loan early?

A: Both allow for foreclosure, but personal loans might have slightly higher prepayment charges.