Buying a House? Why a Home Loan is Better Than a Personal Loan

Table of Contents

- • Introduction

- • Understanding Home Loans and Personal Loans

-

- 1. What is a Home Loan?

- 2. What is a Personal Loan?

- • Why Choose a Home Loan Over a Personal Loan?

-

- 1. Lower Interest Rates

- 2. Longer Tenure Options

- 3. Tax Benefits

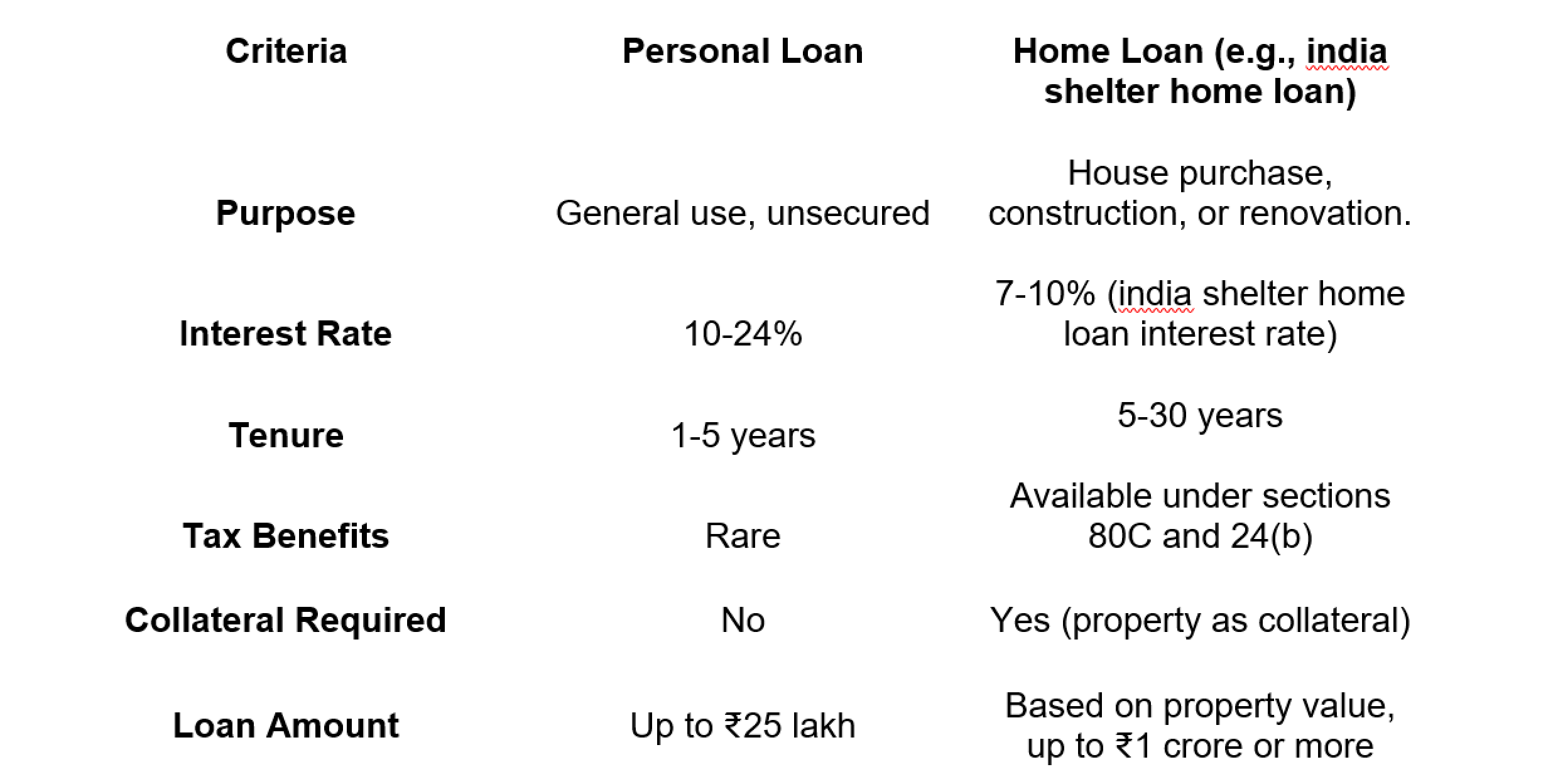

- • Comparison: Personal Loan vs Home Loan

-

- 1. Purpose and Eligibility

- 2. India shelter home loan interest rate vs Personal Loan Interest Rates

- 3. Loan Amount and Tenure

- • Advantages of india shelter home loan

- • FAQs

- • Summary

Introduction

Buying a house is one of the most significant milestones in life. For many in India, this dream is often realized with financial assistance in the form of loans. But when it comes to choosing the right loan, there is often confusion: should you opt for a home loan or a personal loan? This blog dives into why a home loan, particularly an India shelter home loan, is a better choice than a personal loan for purchasing a house.

Understanding Home Loans and Personal Loans

What is a Home Loan?

A home loan is a secured loan offered by financial institutions to help individuals buy or construct a house. The house itself acts as collateral until the loan is repaid. For instance, an India shelter home loan is tailored to provide competitive interest rates and flexible repayment options for home buyers.

What is a Personal Loan?

A personal loan is an unsecured loan that can be used for various purposes, including home-related expenses. Since it is unsecured, personal loans often come with higher interest rates and shorter repayment tenures.

Why Choose a Home Loan Over a Personal Loan?

1. Lower Interest Rates

When comparing the India shelter home loan interest rate with personal loan rates, home loans have significantly lower interest rates. While personal loan rates can go as high as 18-24%, home loans often range between 7-10%.

2. Longer Tenure Options

Home loans offer longer repayment tenures, typically up to 20-30 years, reducing the monthly burden. Personal loans, on the other hand, usually have a maximum tenure of 5 years, leading to higher EMIs.

3. Tax Benefits

Home loans provide tax benefits under sections 80C and 24(b) of the Income Tax Act. Borrowers can claim deductions on both principal and interest amounts. Personal loans do not offer such benefits unless explicitly linked to house renovation or purchase.

4. Larger Loan Amounts

The loan amount sanctioned under a home loan is generally much higher than a personal loan. For instance, with an India shelter home loan, you can get funding up to 85-90% of the property value, while personal loans usually cap at ₹20-25 lakh.

Comparison: PersonalLoan vs Home Loan

Advantages of india shelter home loan

1. Tailored Interest Rates

The india shelter home loan interest rate is highly competitive, making homeownership affordable.

2. Flexible Repayment Plans

Borrowers can choose repayment tenures aligned with their financial goals.

3. Customer Support

India shelter home loan providers ensure customer satisfaction with personalized guidance.

4. Higher Loan-to-Value (LTV) Ratio

LTV ratios often range from 80-90%, reducing the need for excessive upfront payments.

5. Tax Savings

Borrowers can claim tax benefits on both interest and principal repayments.

In conclusion, while personal loans offer flexibility, they are not the best choice for purchasing a house due to high interest rates, limited tax benefits, and shorter repayment tenures. A home loan, especially an Indian shelter home loan, is tailored to meet the specific needs of homebuyers, offering lower interest rates, tax benefits, and longer repayment periods. Choosing the right home loan allows you to turn your dream of homeownership into reality without financial stress.

If you're planning to buy a house, consider the long-term advantages of a home loan. With competitive options like the India shelter home loan, you can secure your future and enjoy the comfort of your dream home.

Frequently Asked Questions

Q1: Can I use a personal loan to buy a house?

A: Yes, but it is not advisable due to higher interest rates and shorter repayment tenures compared to a home loan.

Q2: What are the benefits of choosing an India shelter home loan?

An Indian shelter home loan offers competitive interest rates, longer tenures, tax benefits, and high LTV ratios, making it ideal for homebuyers.

Q3: Is a home loan better than a personal loan for house renovation?

Yes, home loans offer lower interest rates and tax benefits even for home renovation, whereas personal loans do not.