Online vs. In-Branch Instant Personal Loans: Which Option Is Better for You?

Table of Contents

- • Introduction

- • What Are Instant Personal Loans?

-

• Online Personal Loan Benefits

- 1. Convenience

- 2. Speed and Accessibility

- 3. Competitive Interest Rates

-

• In-Branch Personal Loans: Pros and Cons

- 1. Personal Assistance>

- 2. Documentation Process>

- 3. Accessibility Challenges>

-

• Online vs. In-Branch: Which Option Is Better for You?

- 1. Key Comparison Factors

- 2. Suitability for Different Needs

- • Frequently Asked Questions (FAQs)

Introduction

In today’s busy world, getting financial help quickly is a top priority for many. Whether it’s for a medical emergency, a wedding, or paying off debt, instant personal loans have changed how people borrow money. There are two main options: online personal loans and traditional loans from banks. This blog will explain the pros and cons of each to help you decide which one is right for you.

What Are Instant Personal Loans?

An instant personal loan is a fast, unsecured loan that gives you money right after approval. These loans are great for urgent needs and don’t require any collateral. You can apply for them online or by visiting a bank branch.

Online Personal Loan Benefits

Convenience

A big advantage of applying for a loan online is how convenient it is. You can compare lenders, check interest rates, and apply - all without leaving your home.

Speed and Accessibility

Online personal loans use technology to make the process faster. Many platforms use AI to approve and send the money in minutes.

Competitive Interest Rates

Online lenders usually have lower operating costs, so they can offer lower interest rates compared to traditional banks.

Transparent Processes

Online platforms allow borrowers to track application progress in real-time. Additionally, loan calculators and eligibility tools help in making informed decisions.

In-Branch Personal Loans: Pros and Cons

Personal Assistance

One significant advantage of visiting a branch is direct interaction with a loan officer. This can be beneficial for borrowers who prefer discussing terms face-to-face.

Documentation Process

In-branch loans may require extensive paperwork, which could delay the process. However, assistance in filling out forms ensures accuracy.

Accessibility Challenges

For individuals living in remote areas or those with mobility constraints, reaching a branch can be inconvenient.

Online vs. In-Branch: Which Option Is Better for You?

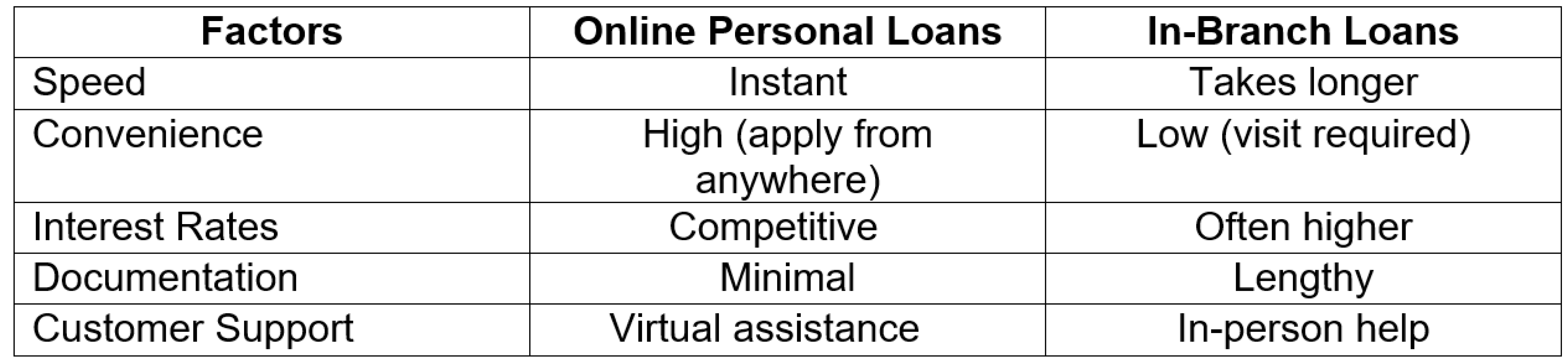

Key Comparison Factors

Suitability for Different Needs

• Online loans are great for people who are comfortable with technology and need money quickly.

• In-branch loans are a better option for those who prefer face-to-face guidance or aren’t familiar with online methods.

Deciding between online personal loans and in-branch loans comes down to what works best for you, how quickly you need the money, and how comfortable you are with technology. Online loans are quick and easy but need some tech skills, while in-branch loans give your personal help but take more time.

Quick Summary

- • Online loans: Fast and convenient but need basic tech skills.

- • In-branch loans: Offer personal help but take longer.

Think about your needs and pick the option that suits you best.

Frequently Asked Questions About Instant Short-Term Loans

Q1. Are online personal loans secure?

A: Yes, trusted online platforms use strong security measures to keep your information safe. Just make sure to check if the lender is legitimate before applying.

Q2: Do online loans have higher interest rates?

A: Not necessarily. Online lenders often provide competitive rates due to lower operational costs.

Q3: How quickly can I get an instant online personal loan?

A: Many online lenders disburse funds within minutes to a few hours after approval.