How Your Credit Score Impacts Personal Loan Interest Rates

Table of Contents

- • Introduction

- • What is a Credit Score?

- • The Link Between Credit Scores and Personal Loan Interest Rates

- • How Credit Scores are Calculated

- • How Different Credit Score Ranges Affect Interest Rates

- • Ways to Improve Your Credit Score

- • Why Lenders Care About Credit Scores

- • Conclusion

- • FAQs

Introduction

Have you ever wondered why personal loan interest rates vary so much from person to person? It all comes down to one critical factor your credit score. Understanding how your credit score impacts personal loan interest rates can save you a lot of money and set you on the path to financial freedom. In this blog, we’ll break it all down in an easy, conversational way. Let’s get started!

What is a Credit Score?

A credit score is like your financial report card. It’s a three-digit number that tells lenders how likely you are to repay a loan. Scores typically range from 300 to 850, with higher scores signaling lower credit risk. Credit scores are calculated based on your credit history, payment behavior, and debt levels. So, why does this matter when you’re applying for a personal loan? Simple - your credit score determines the interest rate you’ll be offered. The higher your score, the lower your personal loan interest rates.

The Link Between Credit Scores and Personal Loan Interest Rates

When you apply for a personal loan, lenders use your credit score as a primary factor to decide how much interest to charge. Think of it this way: A high credit score shows lenders you’re a low-risk borrower, so they reward you with lower personal loan interest rates. On the flip side, a lower credit score means higher risk, and that often leads to sky-high interest rates.

For example:

• Excellent Credit (750+): You may get an interest rate as low as 10.5%.

• Good Credit (700-749): Rates could hover around 11%.

• Fair Credit (650-699): Expect rates in the 15% range.

• Poor Credit (<550): Rates can exceed 20%.

How Credit Scores are Calculated

Understanding how credit scores are calculated can help you take control of your financial future. Here are the major factors:

• Payment History (35%): Pay your bills on time to boost your score.

• Credit Utilization (30%): Keep your credit card balances low compared to your limits.

• Credit History Length (15%): A longer credit history helps.

• Credit Mix (10%): Having a mix of credit types (e.g., credit cards, mortgages) is a good sign.

• New Credit (10%): Avoid opening too many new accounts at once.

The good news? Improving even one of these factors can have a noticeable impact on your personal loan interest rates.

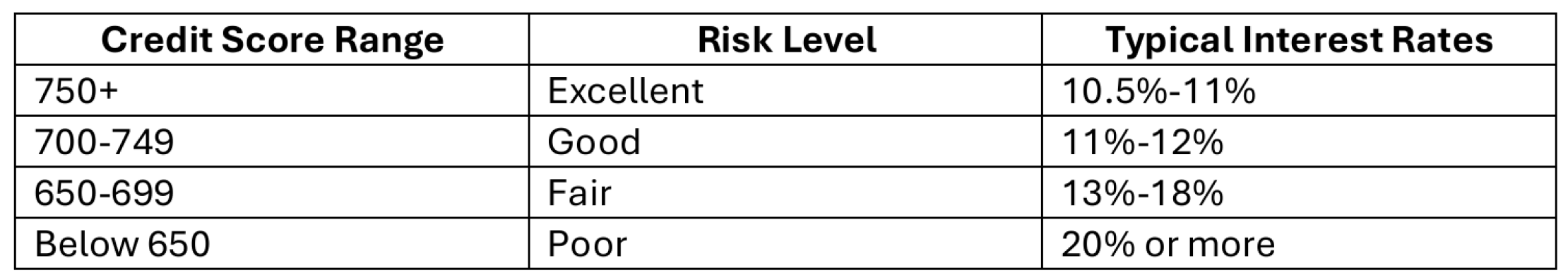

How Different Credit Score Ranges Affect Interest Rates

Here’s a closer look at how credit score ranges can influence your personal loan interest rates:

As you can see, even a small improvement in your credit score can result in significant savings over the life of a loan.

Ways to Improve Your Credit Score

If your credit score isn’t where you want it to be, don’t worry. There are actionable steps you can take to improve it:

• Pay Bills on Time: Late payments hurt your score more than anything else.

• Reduce Debt: Pay down high-interest credit cards.

• Check Your Credit Report: Look for errors and dispute them.

• Keep Old Accounts Open: Longer credit history is better.

• Limit Hard Inquiries: Avoid applying for too much new credit at once.

These steps won't just improve your credit score; they'll also help you secure better personal loan interest rates.

Why Lenders Care About Credit Scores

Lenders are in the business of assessing risk. Your credit score provides a snapshot of your financial reliability. A higher score tells lenders that you’re likely to repay your loan on time, which makes you less risky. This is why borrowers with high credit scores are rewarded with lower personal loan interest rates. On the other hand, a low score means you’re seen as a high-risk borrower, leading to higher rates or even loan rejections. Understanding how your credit score impacts personal loan interest rates empowers you to make smarter financial decisions. Whether you’re planning to consolidate debt, fund a large expense, or achieve a personal milestone, knowing your credit score can save you money and stress. Start by checking your credit report, identifying areas for improvement, and taking steps to boost your score. Your wallet will be thankful!

Ready to get started? Take control of your credit today and unlock better personal loan interest rates tomorrow.

Frequently Asked Questions

Q1: What is the ideal credit score to get the lowest personal loan interest rates?

A: Generally, a score above 750 will qualify you for the best personal loan interest rates.

Q2: Can I get a personal loan with bad credit?

A: Yes, but expect to pay much higher interest rates. You might also need a cosigner.

Q3: How quickly can I improve my credit score?

A: Significant improvements can take 3-6 months with consistent effort, such as paying down debt and making on-time payments.