RBI's No Foreclosure Charges Rule - Simplified for you

The RBI's recent circular has good news for borrowers!

Starting January 1, 2026, most floating-rate loans won't be able to charge for

foreclosure. But does this apply to your loan?

Let's break it down in simple terms.

At Ayaan Finserve India, we've always believed in transparent lending. In fact, we never charged foreclosure fees - not because of regulations, but because it's the right thing to do for our customers.

Official RBI documents:

Who Benefits and Who Does Not

Who Benefits:

- Salaried individuals with floating-rate personal loans

- Small business owners with eligible floating-rate loans

- Borrowers from banks, NBFCs, and co-operative banks

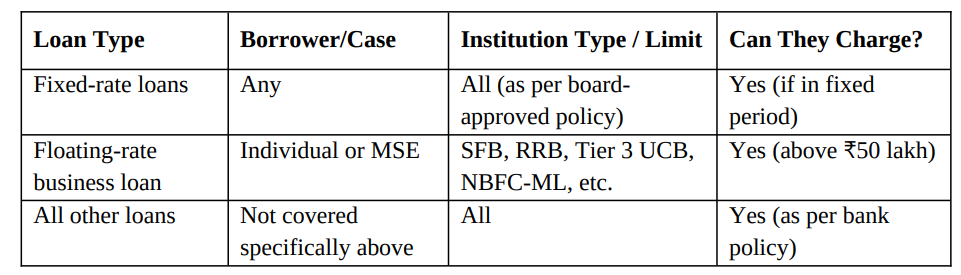

Who Might Still Pay Charges:

- Fixed-rate loan borrowers

- Large business loans above 50 lakh

- Certain specialised loan types

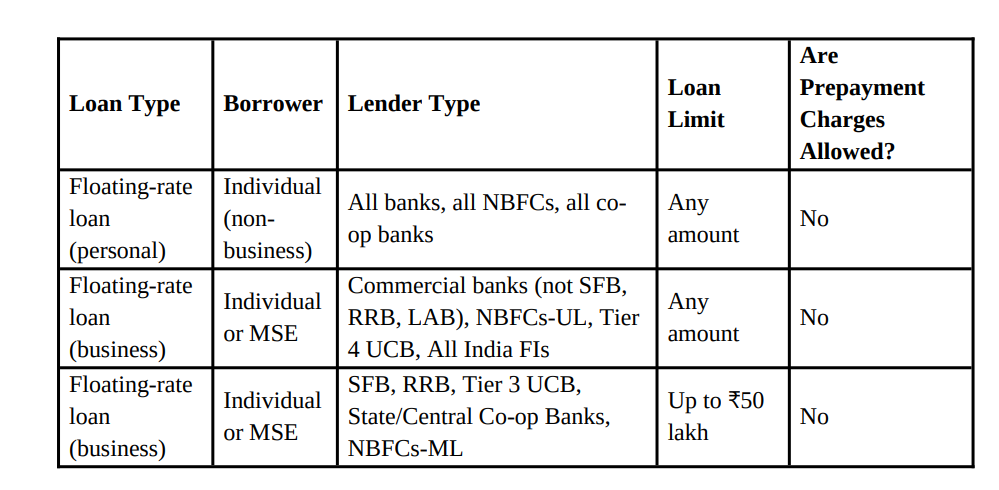

When Are Prepayment Charges Banned?

Key Entities Covered

• MSEs: Micro and Small Enterprises

• UCBs: Urban Co-operative Banks

• SFBs: Small Finance Banks

• NBFCs:Non-Banking Financial Companies

When Prepayment Charges Still Apply?

Real-Life Examples

NO CHARGES- ₹35L home loan (floating) from any bank

- ₹8L personal loan (floating) from NBFC

- ₹40L business loan (floating) from SFB

- ₹60L+ business loan from SFB

- 5-year fixed-rate education loan

Renewable Loan Types That Can Avoid Foreclosure Charges

1. Floating Rate Personal Loans

All floating-rate loans for personal needs - whether for your home, car, education or other expenses - won't have prepayment penalties if they're either:

- Brand new loans taken after January 1, 2026

- Existing loans that get renewed after this date

2. Floating Rate Business Loans

Small business owners and micro enterprises get relief too. Your floating-rate business loans escape foreclosure charges when:

- The loan amount is within limits

- The loan is either new or renewed after the 2026 deadline

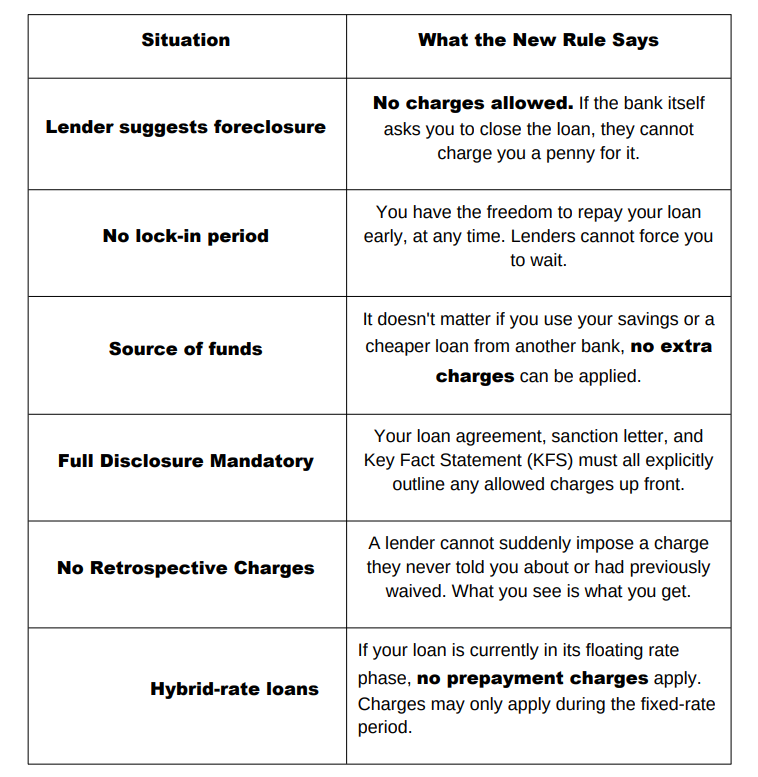

3. Flexible Credit Facilities

For overdrafts, cash credit and demand loans, you can avoid charges by:

- Informing your lender before renewal date

- Clearly stating you want to close the facility

4. Hybrid Loan Products

Even if you have combination loans with both fixed and floating rate periods:

- The floating rate portion qualifies for no charges

- Applies when renewed or converted to floating rate

Loan Types Exempt from Foreclosure Charges

• Fixed Rate Loans: If a fixed rate loan is issued or renewed on or after January 1, 2026, lenders may continue to levy prepayment charges, depending on their internal policies.

• Business Loans: In cases where business loans exceed the prescribed thresholds, certain categories of lenders, such as Tier 1 and Tier 2 Urban Cooperative Banks (UCBs) or NBFCs in the middle layer may impose prepayment charges, even when such loans are renewed.

• Excluded Loan Categories:Loans such as foreign currency borrowings, export finance/credit, and other specified categories are not covered under these provisions and remain outside the scope of prepayment penalty restrictions.

Ready for a loan that sets you free?

Get instant access to unsecured personal loans up to 50,000 for salaried ₹ individuals. No traps, no tricks, and certainly no fees for paying early.

Apply for Your No-Cost Foreclosure Loan Today

The Universal Rules for All Borrowerss

The RBI's new circular isn't just about who gets charged; it lays down some powerful, borrower-friendly rules that apply across the board. Here’s what you need to know:

Exceptions: Where These Rules Don’t Apply

It’s important to know that this RBI circular focuses on standard rupee loans. The ban does not apply to the following:

• Foreign Currency Loans: Borrowings in US Dollars, Euros, etc.

• Export Credit: Loans specifically for financing exports.

• Structured Obligations:Complex, custom-built financing deals for large corporations.

Conclusion

Here’s the quick summary of everything we discussed:

Effective January 1, 2026 , the RBI has banned foreclosure and pre-payment charges on most floating-rate loans for:

• All individuals(for personal loans like home, car, personal).

• Individuals and Micro & Small Enterprises (MSEs)(for business purposes) can borrow up to 50 lakh for business purposes through lenders ₹ like Small Finance Banks.

This applies to loans from almost all lenders: banks, NBFCs, and co-operative banks.