Decoding Emergency Fund for the Indian Scenario

What It Is, Why It Matters & Where to Keep It

What is Emergency Fund?

An emergency fund is money you save for real emergencies. It is not something you save for everyday costs like going to festivals or buying new things. It is only for unforeseen circumstances, like an urgent home repair, including a job loss, or a family health issue. This fund keeps you safe, so you don't have to borrow money at high cost; that’s why building an emergency fund is essential for every Indian household.

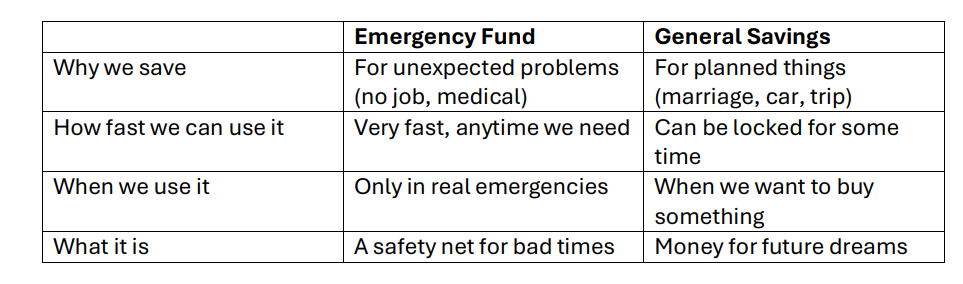

Difference between emergency fund & savings

Many people think their normal savings are enough. But an emergency fund is different. See the table below:

Why is an Emergency Fund Important?

In India, where family is everything, building an emergency fund is like creating a protective financial shield.

For Medical Problems

Health issues come without warning. This fund helps you pay hospital bills quickly, so you can focus on getting better, not on money problems.

For When You Lose Your Job

If you suddenly have no income, this fund pays for your food, rent, and bills for a few months. This gives you time to find a new job without tension.

For Natural Disasters

During floods or storms, you might need to leave your home or repair it. Having cash ready is very important at such times.

To Avoid High-Cost Loans

Without savings, people borrow from moneylenders or take expensive loans. Your emergency fund saves you from this debt trap.

What Happens If You Do Not Have an Emergency Fund?

If you don't have such savings, a money problem can force you into difficult situations. In India, people often do this:

• Ask relatives for money: This can be embarrassing and strain relationships.

• Use your wife's or husband's savings from their family: This adds more stress.

• Sell your mother's or wife's gold jewellery: This means losing family wealth. internal policies.

• Go to a local moneylender: They charge very high interest, which is dangerous.

• Break your Fixed Deposit (FD): You lose the interest, and your future savings are affected.

How to Build an Emergency Fund in India?

How to build an emergency fund in India is simple if you follow a few smart steps.

1. Set a Goal:to save enough money to cover three to six months' worth of your major expenses, such as rent, food, and loan payments. Try to save between ₹60,000 and ₹1,20,000 if your monthly expenses are ₹20,000.

2. Save First: When you get your salary, put money into this fund first. Then use the rest for your monthly costs.

3. Start Small: Save what you can, even ₹500 or ₹1000 every month. The habit is important. Use your bonus or gift money to add to this fund.

4. Make it Automatic:Ask your bank to automatically transfer a fixed amount from your salary account to your emergency fund account every month. This is the easiest way.

Where to Keep Emergency Fund & Why?

You must keep this money safe, but also decide where to keep emergency fund savings so you can access it quickly, even at night or on a Sunday.

• Keeping all cash at home is not safe: It can be stolen or damaged in a fire or flood.

• Keeping it all in a Fixed Deposit (FD) is a problem: You cannot withdraw it easily on a bank holiday. Breaking an FD early also reduces your interest.

The best place to keep emergency fund in India is a balanced approach that ensures both safety and easy access.

• Keep most of the money in a Savings Accountwith your mobile banking active. This lets you transfer money anytime.

• Keep a small amount of cash locked in your home for immediate needs.

Ayaan Finserve India is Here to Help When Your Savings Are Not Enough!

Sometimes, an emergency can be too big, and your savings may not be enough. In such urgent times, Ayaan Finserve India is here to support you.

We give instant, short-term personal loans of up to ₹50,000 to help you in that situation. Our process is fully online, needs no property for security, and the money can be in your bank account quickly. We have clear rules and no extra charges if you repay early.

Big expense? Savings not enough?

Get an instant loan up to ₹50,000 in 30 minutes!

Apply Now!

Frequently Asked Questions

What to do if something like demonetization happens again?

During demonetization, we saw how Indian families, especially women, manage money wisely. The lesson is: do not keep all your emergency fund as cash. Keep most of it in your bank account and use UPI or mobile banking. But also keep some cash at home for times when cards and phones don't work.

Is there any alternative to an emergency fund?

A good health insurance policy is very important for medical emergencies. But for other problems like no job or a broken vehicle, a cash emergency fund is the best and most direct help.

How much emergency fund should I keep?

You should save enough to run your house for 3 to 6 months without any income. If you are the only earning member, try to save for up to 9 months.

Can I use my emergency fund for planned expenses?

No. If you use this fund for a holiday or a new phone, it will not be there when a real emergency comes. Save separately for your fun expenses and goals.

Where exactly should I park my emergency fund?

The best place is a mix. Keep some money in your main savings account for instant use and some in a Fixed Deposit to earn more interest. Choose what makes you feel secure and lets you sleep peacefully at night.